Reinventing Lending for MSMEs: Embracing Data-Driven Decisions to Elevate Customer Experience

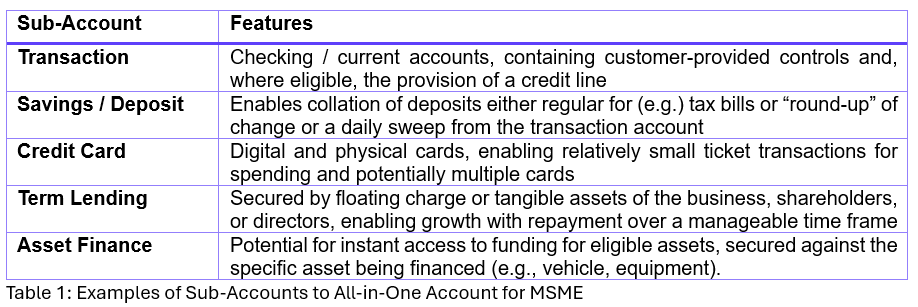

The article by Accenture points to the need for banks and non-bank Financial Institutions (NBFIs) also, to “craft intuitive, end-to-end digital experiences to satisfy borrower demands for a seamless lending process.” It goes on to suggest an all-in-one account that enables, for MSMEs, the ability to have within a single account, sub-accounts, enabling differing lending products.

For lenders, meeting this demand means creating versatile account structures that offer a flexible range of sub-accounts, giving MSMEs greater financial control and agility.

To make this vision a reality, three core components are essential:

- Lender-Configurable Product Offerings

- A Unified Credit Limit Across Products

- A Modern Core Lending Platform

Each of these elements plays a pivotal role in reshaping MSME lending, enabling lenders to adapt to market shifts with unprecedented agility. Let’s delve deeper into each.

Lender-Configurable Product Offerings

For lenders - whether banks, NBFIs, or other fintech businesses - staying ahead of market changes is key to success. But adapting to evolving market conditions can be challenging if reliant on IT teams for every adjustment. A lending platform that empowers lenders to independently configure products, risk assessments and criteria, enables them to respond rapidly to new opportunities.

This flexibility is a game-changer, allowing lenders to adjust to market shifts without needing extensive tech intervention. When combined with AI and machine learning, lenders can also proactively optimize offerings based on predictive insights, creating a stronger competitive edge.

A Unified Credit Limit Across Multiple Products

In corporate and commercial lending, large businesses often have a single credit limit that spans multiple products. Extending this concept to MSMEs, with an automated decision-making process, allows lenders to offer a multi-product package within a single credit limit. Borrowers simply need to select their preferred products in order of preference, and lenders can handle the rest.

Here’s how it works:

- Future Cash Flow Forecasting: By analyzing cash flow data, lenders can predict an MSME’s financial capacity to support different products.

- Credit Risk Grading: Recognizing that each product carries unique risks, lenders can apply risk ratings both per product and across the portfolio.

- Customizable Product Criteria: With modular technology, lenders can tailor criteria for each product within the overarching credit limit.

At ezbob, we’ve developed a unified credit solution that brings this vision to life, enabling lenders to offer a range of products seamlessly under a single application. It’s a streamlined approach that empowers MSMEs while simplifying lending processes. Many have said that JRR Tolkien was prescient, but perhaps not in as direct a manner as this!

The Power of a Modern Core Platform

A modern core lending platform, enriched with AI and machine learning, has the potential to revolutionize markets. This platform must not only manage products and orchestrate decision-making but also seamlessly integrate with banking systems, including both lending and savings accounts. This approach allows for a consolidated view on capital consumption, liquidity, and financial health - crucial insights drawn from lessons of the 2008 financial crisis.

By implementing this next-generation platform, lenders can operate with real-time agility, capturing a first-mover advantage that distinguishes them in competitive markets.

The Future of MSME Lending Starts Here

For MSME lenders, the key to staying relevant is the ability to innovate. By deploying configurable offerings, unified credit limits, and a robust lending platform. In this way lenders can provide more personalized and effective solutions for MSMEs.