Lending to Sole Traders and Micro-Businesses: Thriving Amid Economic Challenges

Understanding the Current Economic Climate

The UK economy today presents a mixed picture. On the brighter side, the unprecedented consumer price inflation of 2023, which exceeded 10%, appears to be a thing of the past. The Office for Budget Responsibility (OBR) projects inflation to hover near the 2% target through 2029. However, challenges remain: UK five-year gilt yields are forecasted to rise to around 4%, adding pressure to borrowing costs and business operations.

Economic Headwinds for Small Businesses

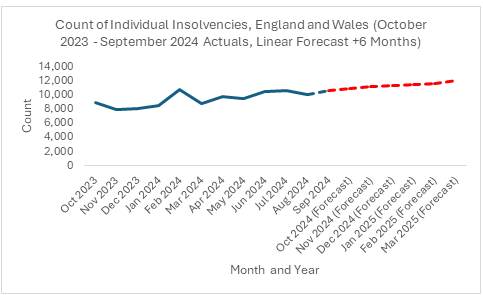

Sole traders and micro-businesses, particularly those in B2C markets or with high fixed costs like retail premises and complex supply chains, continue to grapple with the ripple effects of the cost-of-living crisis. Insolvencies among small businesses remain a concern, as highlighted by recent data from the UK Insolvency Service (see Figure 1). For businesses with solid capital bases, opportunities to gain market share exist, but many others have struggled to survive.

Figure 1: Count of Individual Insolvencies, England and Wales (Source: UK Government Insolvency Service)

Rising Borrowing Costs for Small Businesses

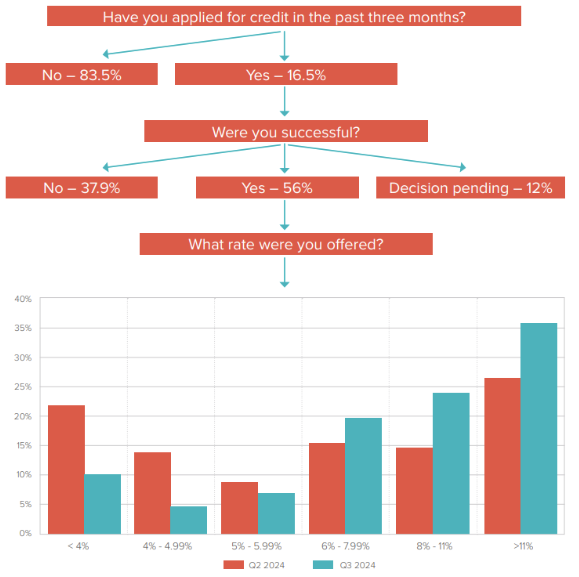

Small businesses face growing challenges in accessing credit. According to the Federation of Small Businesses (FSB), the cost of credit has risen, and rejection rates for loan applications are climbing.

Figure 2: Flow of Applications for Credit and Credit Pricing, Q2 2024 to Q3 2024 (Source: FSB)

Key insights include:

- Increased credit demand: Applications rose from 15.7% in Q2 2024 to 16.5% in Q3 2024 (a 4.8% increase).

- Higher rejection rates: Loan rejection rates surged from 33.4% to 37.9% in the same period, marking an 11.8% jump.

- Pending decisions: A significant 12% of applications remain undecided, showcasing inefficiencies that advanced analytics and AI could address.

The Role of Automation in Lending

Automation, powered by advanced AI/ML technologies, holds the key to revolutionizing lending for small businesses. As inflation stabilizes and economic conditions normalize, banks and lenders have a unique opportunity to leverage these tools for competitive advantage.

Here’s how automation can transform small business lending:

- Streamlined Applicant Screening: AI can quickly identify ineligible applicants, enabling lenders to focus on viable candidates.

- Optimized Portfolio Profitability: Profitability-optimized credit risk (POCR) ensures that lending portfolios are tailored for maximum returns without increasing risk-weighted assets.

- Enhanced Customer Experience: By asking only relevant questions, lenders can significantly reduce decision times and create a seamless digital journey for applicants.

Why Now Is the Time to Act

With inflation forecasted to stabilize below 2.5% and the UK PRA’s assurance that SME lending won’t increase risk-weighted assets, lenders can expand their SME portfolios with confidence. By embracing automation and AI, banks can not only improve decision-making but also gain a competitive edge in the marketplace.

How ezbob Can Help

At ezbob, we provide a modular lending platform that empowers business users to refine criteria and processes without relying on IT teams. Our platform offers:

- Tailored customer journeys

- Seamless integration of advanced AI/ML decision-making tools

- The flexibility to adapt quickly to market changes

Ready to unlock the full potential of your small business lending operations? Let’s talk!