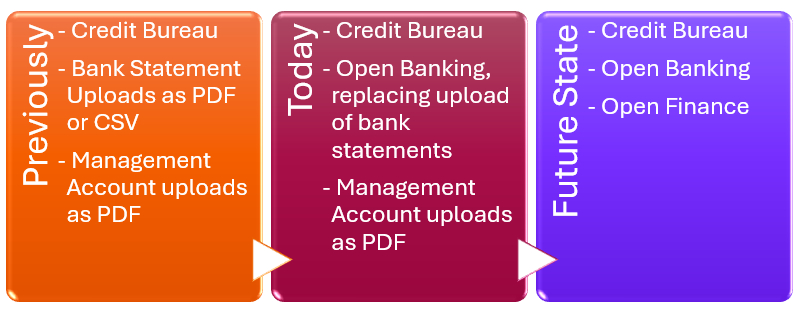

From Open Banking to Open Finance: The Next Evolution in SME Lending

However, as the financial needs of SMEs become more complex, Open Banking alone may no longer be enough. This is where Open Finance comes in - a broader framework that extends data access beyond traditional banking to include pensions, investments, insurance, and other financial products.

For MSEs, Open Finance unlocks greater access to credit, more seamless financial management, and deeper innovation within the lending ecosystem. By leveraging a wider set of financial data, lenders can gain richer insights, tailor products more precisely, and ultimately bridge critical funding gaps for small enterprises.

The shift from Open Banking to Open Finance isn’t just an evolution - it’s a strategic leap toward a more inclusive, data-driven financial ecosystem. The question now is: how quickly will the industry embrace it?

The Limitations of Open Banking for SMEs

There is no doubt that Open Banking has enabled better access to some financial products, as it primarily focuses on bank transaction data, together with further expanding the granularity of CDD and EDD, but this limited scope presents information asymmetry challenges for lenders seeking to lend to MSBs and MSBs seeking finance:

- Incomplete Financial Picture – Open Banking relies on bank account transactions, which may not fully capture the financial health of a business, and for micro businesses have transferred out to other accounts which may not be captured using the Open Banking structure. Many small enterprises use alternative financial tools like digital wallets, crowdfunding, and online marketplaces that are outside traditional banking channels. Whilst there is a benefit to having the “true” picture of business financial health from bank accounts, this provides an incomplete picture of total cashflows.

- Limited Credit Assessment Criteria – Traditional creditworthiness assessments using bank statements and credit scores may not always reflect a business's true financial health. MSEs may have non-traditional revenue streams, including gig work, invoice factoring, and digital payments, which Open Banking may not always incorporate.

- Fragmented Data Sources – SMEs often manage their finances across multiple platforms, including e-commerce platforms, accounting software, and payment gateways. Open Banking may not integrate all these data sources, leading to an incomplete assessment of financial standing: whilst there may be, for example, a picture of income from a merchant acquirer, chargebacks or disputes cannot be identified.

So, what’s the impact of these three points? First, lenders are not able to assess the credit risk effectively as represented by the applicant for financing. Second, borrowers are not getting offers of financing that truly represent the nature and cash flow of their businesses. Finally, as information asymmetry is reduced, default rates may fall and thus the cost of capital for the lender will reduce meaning that all parties to a transaction are able to operate profitably.

How Open Finance Enhances SME Lending

Open Finance takes the principles of Open Banking further by incorporating financial data from sources beyond traditional banks and especially accounting aggregation data sources, which takes information, explicitly consented by applicants, from online accounting platforms such as Microsoft Dynamics 365, QuickBooks, Exact Online, FreeAgent, FreshBooks, MYOB, Oracle NetSuite, Sage, Wave, Xero, and Zoho Books.

This broader and more interconnected approach benefits SMEs products and lending in several ways:

- A Holistic View of Financial Health - With Open Finance, lenders can access a comprehensive dataset that includes revenue from e-commerce sales, merchant acquiring, digital wallets, tax records, and even business performance indicators from accounting software such as current ratios and both debtor and creditor days. This creates a more accurate and real-time view of a business’s financial health, reduces information asymmetry, and enables the borrower to share a better picture with the lender to ensure that the lender is able to accurately value the business and thus the amount to be advance.

- Alternative Credit Scoring Models - Open Finance continues the path previously treaded with Open Banking by enabling new credit assessment models that go beyond traditional credit bureau and banking data. As lenders incorporate transaction history from digital wallets, merchant platform revenues, and subscription-based income to assess creditworthiness, together with a better understanding of payments such as salaries, taxes, personal drawings, and dividends. This is particularly beneficial for businesses that may lack a strong banking history but have steady cash flow from other sources: the quintessential micro business in an economy where cash or small value payments are a regular feature.

- Faster, Better, and More Inclusive Loan Approvals - By leveraging real-time financial data from diverse sources, Open Finance reduces the time to approve credit. Automated data aggregation and AI-driven analysis allow lenders to make quicker, more informed lending decisions and provide (for example) cashflow forecasts as a value-add for their micro businesses: not for nothing did a major bank in the UK recently acquire an online accounting platform that is offered to its own customers. Additionally, small businesses that were previously underserved by traditional banks can now access credit based on a broader set of financial indicators.

- Enhanced Risk Management for Financial Institutions - For lenders, Open Finance reduces the risk of default (often because of business failure) associated with lending to MSBs. With access to a more diversified financial dataset, lenders can better predict default risks and offer more tailored products, both for borrowing and for investing. Some lenders, when operating in higher risk sectors, might choose to consider covenant default their being unable to access Open Finance data on an ongoing basis (as some do with Open Banking), but communication with the borrower is absolutely key to this. This results in more sustainable practices that benefit both financial institutions and small business owners.

- Improved Financial Planning for MSBs - Beyond lending, Open Finance, with Open Banking alongside it, allows businesses to integrate their financial data across platforms, providing real-time insights into cash flow, expense management, and revenue trends. This empowers business owners to make data-driven decisions and improve financial planning, which in turn strengthens their credit profiles. It would normally be expected that Open Finance and Open Banking would be a mirror image of each other but by combining the two, it is possible to perform bank account reconciliation on a daily, weekly, or monthly basis for the MSB.

The Road Ahead: Challenges and Opportunities

Open Finance presents numerous advantages when operated alongside Open Banking, but its implementation can face challenges:

- Data Security and Privacy – Expanding access to financial data raises concerns about security and data protection. Regulators and fintech companies must ensure that businesses have control over their data and that strict security measures are in place. In both the UK and the European Union, work is already underway on this, beyond the requirements of GDPR.

- Standardisation of APIs – For Open Finance to operate effectively, financial data across different platforms must be standardised, as is the case with the aggregators of data. Industry-wide API standards and interoperability between financial service providers are crucial for seamless integration.

- Regulatory Frameworks – Policymakers must establish clear regulations to govern Open Finance, ensuring consumer protection, data portability, and fair competition among financial service providers. As noted above, it is the case that a reduction in information asymmetry will lead over time to improved pricing for MSBs and reduced default rates for financial institutions and investors.

Despite these challenges, the shift to augment Open Banking with Open Finance holds immense potential for transforming SMEs products in general and lending in particular, and with broader access to financial data, more businesses can secure the credit they need to fuel innovation and economic growth.

Conclusion

Open Finance represents the next step in financial services, offering a comprehensive and inclusive approach to SME lending. By integrating financial data from diverse sources, lenders better assess creditworthiness more accurately, provide faster loan approvals, supporting the growth of underserved businesses. As regulatory frameworks evolve and financial institutions adopt open finance, MSEs will have greater access to the funding they need to thrive in the digital economy.