Application of AI to Credit Risk Measurement and Management for MSMEs

AI and Credit Risk: A Match Decades in the Making

AI and machine learning (AIML) aren’t new inventions. In fact, as evidenced by Professor Geoffrey Hinton's Nobel Prize in 2024, these technologies have been shaping industries since the 1990s, especially in consumer banking. Yet, despite their proven effectiveness, AIML hasn’t been widely applied to MSMEs. Further, how do banks and other lenders provide for the explicability of their AIML models in the absence of significant use? Shapley or Shapley-Laplace values will only take us so far. Why? There’s an ongoing debate: Do banks and tech firms fundamentally misunderstand MSMEs, or is it simply that the credit risk of these businesses is seen as too complex to model accurately? This question is particularly relevant given the data silos that often exist within financial institutions.

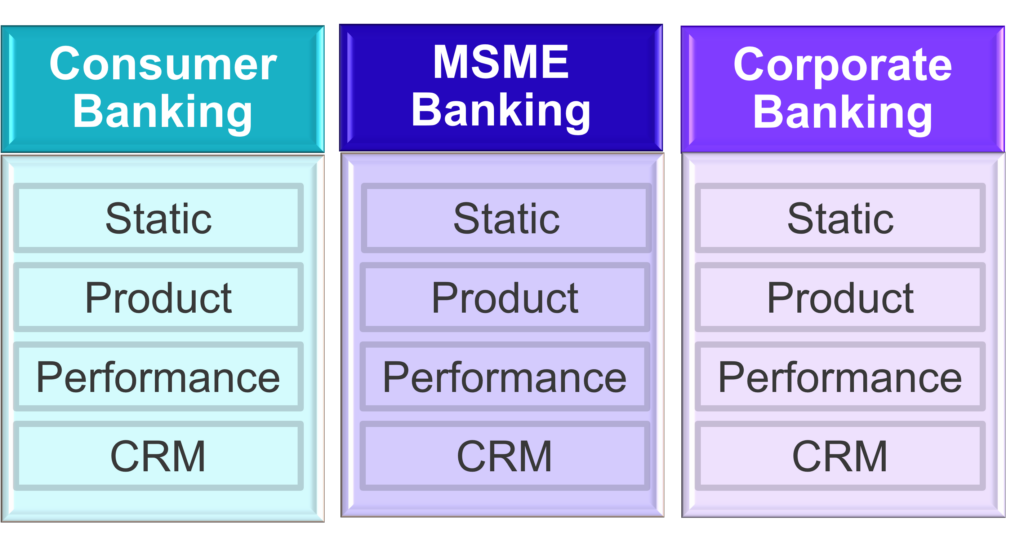

As seen below, at first glance the data structures in MSME and consumer banking appear similar, but the unique complexities of corporate banking, including larger balances and more diverse products, have led to a slower adoption of AI for MSME credit risk management.

Figure 1: Example Data Silos in Major Banking

Overcoming the “Data Desert” in MSME Lending

A common challenge in applying AIML to MSMEs is the perceived lack of data. Often, there’s little to no available information on the businesses themselves, and identifying the key decision-makers, such as beneficial owners or directors, can be difficult.

As there is perceived to be no data, the ability to generate estimates of probability of default (“PD”) are hampered, meaning that lending to MSMEs on an unsecured basis – where PD is at its most important – is disproportionately difficult.

To this end, lending to MSMEs tends to require security, and physical, tangible security that can be exercised if there is a default event. The presence of a security collateral that can be valued and a lien or charge taken over means that comfort for the lender increases.

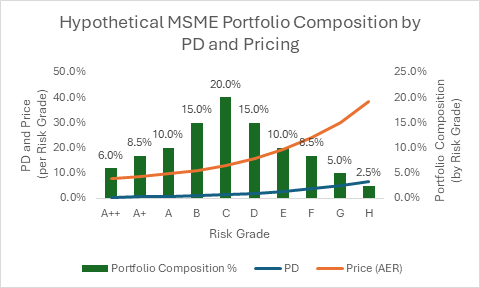

AIML can improve the estimation measurement accuracy of PD and thus the capacity of lenders to improve both scope and the pricing of their commercial offerings to MSMEs: for example, figure two, below, shows possible distribution of MSMEs in a credit portfolio, measured by PD, price (AER) and the composition meaning that instead of having a one-size-fits-all approach, banks are able to lend profitably across the credit curve and that losses, when they occur, are more than compensated for in pricing.

Figure 2: Hypothetical MSME Portfolio Composition and Pricing

Speed and Efficiency: The Future of MSME Lending

While AI can dramatically enhance risk measurement, it’s only part of the equation. To fully capitalize on these insights, banks need modular core lending platforms that streamline the entire lending process. Automated or semi-automated systems can deliver faster, more efficient loan approvals - something MSMEs desperately need. These businesses are often rich in ambition but short on time, and any delay in accessing capital can hinder growth opportunities. Speed to funding is crucial, and banks that can provide quick, hassle-free loans will be the ones to capture the MSME market.

Beyond Risk: Tailored Solutions for MSME Growth

AI’s benefits extend beyond risk management. By leveraging AIML, banks can tailor their offerings to the specific needs of MSMEs, helping them not only survive but thrive in a competitive global marketplace. The ability to provide personalized financial products—combined with expert advice - positions banks as invaluable partners to MSMEs.

It’s not just about offering loans; it’s about enabling growth through regulatory compliance support, faster payments, and other financial services. In regions like the UK and the EU, businesses are already accustomed to features like Faster Payments and SEPA for cross-border transactions, but this level of service isn’t yet standard across the globe. Banks that can offer these advantages to MSMEs in underserved markets will have a clear competitive edge.

Conclusion: The Time for AI in MSME Banking is Now

AI and machine learning aren’t buzzwords - they’re essential tools for modernizing the way banks approach MSME lending. The days of treating MSMEs as a secondary priority must come to an end. By embracing AIML, banks can not only mitigate risk but also unlock new opportunities for growth, both for themselves and the businesses they serve. The future of MSME banking is tech-driven, and the time to act is now.

ezbob’s Core Lending Platform enables banks and financial institutions to deploy AI-driven credit models tailored for MSMEs effectively. It refines the approach to credit risk and enhances the offerings. ezbob has built a suite of AIML models and approaches that can be leveraged by lenders via the ezbob platform.

Curious to learn more? Let’s talk about how we can support your journey into AI-powered lending.